Saturday, December 24, 2011

Comments on the Education and it's Goals

Friday, November 25, 2011

Best Teacher I Ever Had (Reader's Digest, 1991)

by David Owen

Extracted from Reader's Digest (Asian Edition), April 1991, pp. 47-48.

Mr. Whitson taught sixth-grade science. On the first day of class, he gave us a lecture about a creature called the cattywampus, an ill-adapted nocturnal animal that was wiped out during the Ice Age. He passed around a skull as he talked. We all took notes and later had a quiz.

When he returned my paper, I was shocked. There was a big red X through each of my answers. I had failed. There had to be some mistake! I had written down exactly what Mr. Whitson said. Then I realized that everyone in the class had failed. What had happened?

Very simple, Mr. Whitson explained. He had made up all the stuff about the cattywampus. There had never been any such animal. The information in our notes was, therefore, incorrect. Did we expect credit for incorrect answers?

Needless to say, we were outraged. What kind of test was this? And what kind of teacher?

We should have figured it out, Mr. Whitson said. After all, at the every moment he was passing around the cattywampus skull (in truth, a cat's), hadn't he been telling us that no trace of the animal remained? He had described its amazing night vision, the color of its fur and any number of other facts he couldn't have known. He had given the animal a ridiculous name, and we still hadn't been suspicious. The zeroes on our papers would be recorded in his grade book, he said. And they were.

Mr. Whitson said he hoped we would learn something from this experience. Teachers and textbooks are not infallable. In fact, no one is. He told us not to let our minds go to sleep, and to speak up if we ever thought he or the textbook was wrong.

Every class was an adventure with Mr. Whitson. I can still remember some science periods almost from beginning to end. On day he told us that his Volkswagon was a living organism. It took us two full days to put together a refutation he would accept. He didn't let us off the hook until we had proved not only that we knew what an organism was but also that we had the fortitude to stand up for the truth.

We carried our brand-new skepticism into all our classes. This caused problems for the other teachers, who weren't used to being challenged. Our history teacher would be lecturing about something, and then there would be clearings of the throat and someone would say 'cattywampus.'

If I'm ever asked to propose a solution to the problems in our schools, it will be Mr. Whitson. I haven't made any great scientific discoveries, but Mr. Whitson's class gave me and my classmates something just as important: the courage to look people in the eye and tell them they are wrong. He also showed us that you can fun doing it.

Not everyone sees the value in this. I once told an elementary school teacher about Mr. Whitson. The teacher was appalled. "He shouldn't have tricked you like that," he said. I looked that teacher right in the eye and told him that he was wrong.

Ideas on Reforming the Institution of "Permanent Residency"

I take it as a fact that Singapore needs skilled workers and talented individuals from various fields. In order to make terms attractive for these individuals, they should be granted privileges similar to those Singaporeans enjoy. To me, it should not matter even if they skip out on NS. We do not need them to learn how to dig holes in the ground and fill them back up. Rather, we need them to contribute maximally. From this point of view, I would rather have freshman PAP MP Janil Puthucheary spending "the last 10 years saving kids' lives" as opposed to spending the last 7.5 years saving kids' lives and 2.5 years certifying the MCs of reasonably healthy NSFs.

The problem with the present implementation of the PR system is that there is a failure to verify. I, as a technical elitist, would argue that many PRs do not fit the description of "skilled workers" or "talented individuals". I believe that Singapore should grow in a controlled manner, taking in only those who advance our interests.

Verification cannot be entrusted to a central organization except as a rubber stamp to credible nominations. This is so clear and uncontroversial as to not require explicit supporting arguments. I believe that "enlightened self-interest" is the key to the verification of capability or talent. In particular, the "free market" will be able to judge effectively whether a potential PR can contribute sufficiently. Firms can, and will, put a dollar value on the benefit that an individual can generate. It is on this firm bedrock of rational self-interest that I propose we build our PR system.

Firms (private sector or public sector) should sponsor the Permanent Residency of their foreign staff, and those who are not deemed able to contribute should lose their PR status. Sponsorship of Permanent Residency should be expensive enough to provide a clear signal that the firm values the contribution of a PR. (For instance, it might cost, annually, some large fixed sum and plus some fixed percentage of the PR's total annual compensation.) As such, on top of a firm having to offer an attractive enough compensation (along with the promise of PR status) to attract talented foreign staff, it also has to pay a premium to certify its esteem of the capabilities of its foreign staff. This, to me, is credible verification.

Perhaps after at least 5 years of Permanent Residency, a PR might apply for citizenship contingent on continued sponsorship as a PR for a period of time (like 3 months). PRs, whose capabilities would have been credibly certified by then, would find it attractive to take it up at that point. Their employer might offer them a pay raise corresponding to a portion of what it formerly spent to certify them as skilled or talented individuals. A higher compensation package would be a material inducement. If they do not accept citizenship, they are welcome to remain PRs so long as they remain sponsored by some firm.

It is interesting how going back to fundamentals has brought us to something like the "Employment Pass" system. I believe that the intent behind that policy was to use salary as a credible signal. Unfortunately, the signals that the Ministry of Manpower decided on were less than credible as salary paybacks were used as a tool to game that system, which should also be corrected.

I would like to close by emphasizing that the privileges associated with being a PR should be attractive, but Permanent Residency should be a costly employment perk that firms offer to their foreign employees. The willingness to incur a high economic cost is a credible signal of the expectation to reap an even higher gain. Only credible signals should be used in the award of privileges like those of Permanent Residency. Economic signals like the aforementioned might be the default, but the judgment of eminent (not just qualified) figures in the relevant disciplines should be accepted as credible signals as well. All in all: credible signals, credible signals, credible signals.

Friday, November 18, 2011

Idiocy Should be Seen Once and Never Heard of Again

Wednesday, November 16, 2011

A Proposed Auction System for Public Housing

[Edit: But before moving on, I would like to state that I do understand that when supply can be manipulated, prices will naturally shoot up. Thus, it is important that this be executed only once there is a buffer stock of flats and only if there is explicit policy to maintain that buffer stock.]

The allocation of HDB flats will be done through the conduct of regular VCG-based auctions of all available flats in Singapore by HDB, with a reserve price on each flat set to a reasonable value reflective of cost or cost-plus. Interested buyers would first register with HDB and then be issued with accounts to bid for flats. They would then place bids for each flat they are interested in.

In what follows, I intend to recapitulate my description of the auction mechanism and how it works. Then, I will describing the kinds of outcomes generated by the auction through graphs generated from numerical experiments. Some of this will be repeated material (for which I apologize), as it is intended to make this as self-contained as possible.

Auctions and Free-Market Prices

Before moving on, I would like to emphasize that a major aim of using such an auction is to get at the true free market values of flats. I have previously mentioned that personal valuations for flats take into account both economic, relational and personal factors that are mostly unaccounted for in “independent valuations”. Furthermore, the phenomenon of substitution throws another wrench into the work of arriving at an accurate valuation. A household may be willing to consider 3-room, 4-room or 5-room flats. If valuers do not account for this, they will double (or triple) count demand, leading to artificially high values. (This insight was obtained from viewing allocation and pricing output from the auction based on various scenarios.)

While I concede that valuers may have some knowledge of substitution patterns, difficult as they might be to measure, there is little incentive to use it. Furthermore, it is a "forgivable mistake", noting the simplistic "price is determined by intersecting supply and demand" image that many have of economics.

Eliminating Dilemmas

It is, perhaps, underemphasized that potential buyers face dilemmas when flat issues are conducted in “unfortunate orders”. One’s second choice location might be up first, followed by one’s first choice. One then faces the dilemma of whether or not to apply in the first issue. The associated “what if” questions are a needless hassle. Furthermore, it stands to reason that clearing a national public housing auction is likely to increase allocative efficiency.

Characteristics of the Proposed VCG-based Auction

By allocating all available flats (old and new) through a VCG-based auction mechanism where bidders articulate their valuations for the (multiple) flat types they desire in their bids (and revise them periodically until the auction closes), the following will be achieved:

- (i) information about multiple flat types is integrated in the pricing and allocation outcome, (ii) a truly free-market allocation is arrived at, (iii) allocated flats are priced at the lowest possible bid which could have been made without changing the outcome, and (iv) each bidder gains a better picture of his/her preferences as the auction progresses.

Having hopefully motivated the use of an auction mechanism to allocate flats, I would like to sketch the mechanics of the auction. Firstly, this auction mechanism will stand up easily to scrutiny because it is based on a well-known (and well-studied) family of mechanisms called Vickrey-Clarke-Groves (VCG) Mechanisms. In the auction, each bid price is intended to be the maximum amount the relevant bidder is willing to pay for a flat of a particular type in a particular location. Bidders will make bids for every type of flat they are interested in.

The outcome of the auction will be the socially optimal allocation based on the bids made and subject to allocation constraints that HDB has such as reserved quantities for first timers and the Ethnic Integration Policy (EIP). This leads to the achievement of (i).

Furthermore, it may be said that only preferences of buyers and the constraints of the (non-profit seeking) HDB are incorporated into the allocation. As such, the input of external parties seeking to profit off the outcome of the auction is minimized, in all it is arguable that this leads to (ii).

The pricing of each allocated flat is done via externality pricing. That is to say, for each winning bidder, the maximum social welfare of all bidders is computed again with the winning bidder removed. Necessarily, this new number is never larger than the maximum social welfare when all bidders are included. Call the difference between these numbers w. The price that bidder pays is his bid less w. With some thought, it would be clear that had he bid anything more that the price he paid, allocating him that flat would certainly remain part of the optimal allocation, and had he bid less, allocating him that flat would no longer be part of the optimal allocation. For mechanism design neophytes, it may require a bit more time to understand this argument, but it explains (iii). From a different perspective, it stands to reason that the optimal bidding strategy is for a bidder to truthfully bid the actual maximum value he is willing to pay for a flat, and the auction mechanism will not use this information to extract additional revenue from him.

This leads to a major criticism of the VCG Mechanism by academics and auction practitioners: revenue from VCG-based auctions compares poorly to that from other auction forms. This arises as VCG enforces the property of truthfulness by charging winning bidders the lowest amount they could have bid and been allocated a flat, an amount typically much lower than the amount bid, as mentioned in the explanation of (iii). However, having less revenue extracted from winning bidders turns out to be a strength for allocating public housing. Since the mission of HDB is to "provide affordable homes of quality and value", it may be said that selling flats at the reserve price is a mark of successfully meeting housing demand in an affordable fashion and low revenue from the auction is not, in fact, a problem.

Consider conducting the auction in manner where the tentative outcome for one’s bids and the tentative prices for flats in each category are made available at regular intervals, and bidders are able to update their bids in response to tentative outcomes. It cannot be assumed that people have full clarity on the real value of a flat to them. By viewing a tentative outcome, they may realize that they are willing to pay more for a flat of a particular type, or that they have overvalued a flat of a particular type. This explains (iv). It is suggested that prior to the close of the auction, there be a (long) period where results are no longer updated to reduce the incentive of last minute “sniping”.

The Allocation Model for our VCG-based Auction

The Allocation Model is basically defines the characteristics of the socially optimal allocation, expressing it as a mixed-integer linear optimization problem, the objective of which is to pick an allocation which maximizes the total sum of the bids corresponding to allocated flats. Note, however, that the price of the flat is at most the bid price and usually strictly lower.

The parameters that define the problem are:

vij: Bid price of bidder i for a flat of category j

mj: Number of available flats in category j

ojr: Maximum of available flats in category j that members of racial group r may buy

... and the variables that define the allocation:

xij: Boolean variable defining whether bidder i was allocated a flat in category j (for the bidder representing HDB, this is a not a boolean variable, but rather a non-negative integer variable)

So, the following optimization problem is to be solved using linear optimization software: (I know I said that this is an integer program, but the linear relaxation is equivalent. This can be easily shown by an appeal to the Ghouila-Houri characterization of Total Unimodularity, which proves that optimizing any linear objective over the above feasible set can be done efficiently.)

maximize Sum[over bidders i and flat categories j] vij xij

subject to:

- Sum[over flat categories j] xij ≤ 1 for each bidder i except HDB (1)

- Sum[over bidders i] xij = mj for each flat category j (2)

- Sum[over bidders i in racial group r] xij ≤ ojr for each flat category j and racial group r (4)

The set of constraints (1) mean that each bidder (other than HDB) may be allocated at most 1 flat. The set of constraints (2) mean that all flats are allocated. The set of constraints (3) serves to reserve some fraction of flats for first timers. This in turn results in higher prices on second timers due to the higher externality they will impose on other second timers when allocated flats. The set of constraints (4) reflects the government's “Ethnic Integration Policy” (EIP). The inclusion of (4) will probably translate the previous time to sell/time to buy difference for different ethnic groups to a price difference. With this constraint, it would really pay to be among more of those of other races.

One can prove that if the bid prices (other than HDB's) are all not equal (and other non-equal "difference" conditions hold), this integer optimization problem can be relaxed to an equivalent linear optimization problem. (This can be easily engineered and implies big computational savings, which will be necessary for quickly producing an allocation and pricing the allocated flats.) Such a scenario can be engineered by requiring minimal bid increments (of say $100) and incorporating random tie breaking by doctoring bids by random values smaller than the bid increment. This practical measure is similar to allocating flats by ballot, but differs in that it first takes allocative efficiency into account.

Examples

Having outlined the characteristics of the auction, allow me to provide some concrete (albeit simple) examples of bids and outcomes. If only 800 bidders compete for an issue of 1000 "identical" flats, regardless of how wildly high some bidders might bid, all bidders bidding at least the reserve price pay just the reserve price for their flat. In contrast, if 1800 bidders compete for an issue of 1000 "identical" flats, all bidding more than the reserve price, the 1000 winning bidders would end up paying the 1001-st highest bid price. In the setting of auctioning identical items, the VCG auction reduces to the k-th price auction.

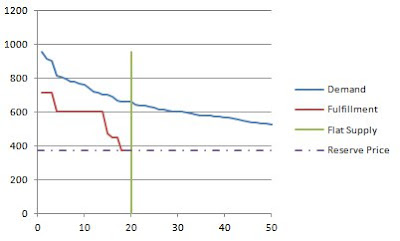

One might visualize the results by using bid prices to describe "demand" and relating it to the quantity of the respective type of flat supplied. Notably, this auction tends to see winning bidders paying less than the price determined by the point where the (assumed vertical) supply curve intersects the "demand curve". This is due to substitution effects, as HDB flats of different types are related goods. This is true for all bidders when no first timer and EIP constraints are included, when those constraints are included this would still typically be true for the first timers.

Now let us look at some auction results. The graphs that follow will depict demand for a type of flat (bid prices), fulfillment (allocation of flats at some price), flat supply for this type of flat, and the reserve price for this type of flat. I've neglected to label the axes, but the vertical axis denotes price and the horizontal axis denotes quantity.

The first example (Figure 1) is a fairly pedestrian one. This particular instance reflects supply exceeding demand for this type of flat, so all demand is satisfied at the reserve price.

Figure 1: Supply exceeds demand

Figure 1: Supply exceeds demand

The next examples (Figure 2 and Figure 3) are part of a small-medium sized example with 2000 bidders (1712 of whom made at least 1 bid) competing for 521 flats in 10 categories. (Data was randomly generated.) About 40% of the bidders are second timers and for each flat category, at most 15% to 30% of the flats may be allocated to second timers. The EIP constraints were not imposed.

In Figure 2, one sees that 13 bidders paid 146 for their flats while the other 44 paid 115. The former group were all second timers, while the latter were all first timers. This illustrates the effect of restricting the number of flats available to a certain group. A similar effect is visible in Figure 3, from the same example. In general, with k "groups" with different constraints on each, one would expect to see k price levels in the fulfillment curve.

Figure 2: Flat Category C0 from a Small-Medium Sized Example

Figure 3: Flat Category C4 from a Small-Medium Sized Example

Figure 3: Flat Category C4 from a Small-Medium Sized Example

The next examples (Figure 4 and Figure 5) are part of a small-medium sized example with 2000 bidders (1476 of whom made at least 1 bid) competing for 297 flats in 10 categories. (Again, data was randomly generated.) About 40% of the bidders are second timers and for each flat category, at most 15% to 30% of the flats may be allocated to second timers. Each flat category was restricted to 70% Chinese buyers, 15% Malay buyers and 10% Indian buyers. However, 80% of the bidders were Chinese, 5% were Malay and 10% were Indian.

In Figures 4 and 5, one sees multiple price levels, corresponding to different subsets of bidders, with each group facing different forms of restriction that increase, in varying degrees, the level of competition for flats between bidders in the respective subsets. In both figures, the highest prices are paid by the second timer ethnic Chinese buyers, due to the restrictions placed on them and the higher competition for available flats within their ethnic group.

Figure 4: Flat Category C0 from a Small Example with EIP Constraints and Unbalanced Demand from Ethnic Groups

Figure 5: Flat Category C1 from a Small Example with EIP Constraints and Unbalanced Demand from Ethnic Groups

Figure 5: Flat Category C1 from a Small Example with EIP Constraints and Unbalanced Demand from Ethnic GroupsHopefully the above examples have been helpful in illustrating how the auction behaves. While some of the examples suggest that prices can get high, I would like to assure the reader that they only get high in the event that supply is inadequate. The fact is, examples with adequate supply are boring, probably with all flats selling at or near the reserve price, these were constructed to exhibit "interesting behavior".

The small-medium example of Figures 2-3 took about 5 sec to solve per optimization problem using an open source solver (GLPK). With about 500 allocations, it actually took just under 50 min to compute the pricing decisions for each flat allocated. A more realistic example with about 15000 bidders competing for about 5000 flats takes about 5 min to solve. However, to generate tentative prices in the auction prices for each and every flat allocated need not be computed. With parallization, much larger instances could be solved to allow tentative results to be refreshed every hour. Commercial software (CPLEX/Gurobi/Xpress MP) might be used if they're found to be much faster.

Closing Remarks

In my assessment, this auction mechanism is technically feasible and produces sensible results. I think this is worthy of exploration as a means for allocating flats in our public housing system.

In presenting this and advocating for it I do bear in mind a certain cautionary note, as so well put by Malcolm Gladwell, against the "infatuation with the things we make". We all have our blinders. With that in mind, I would like to receive comments on this especially those that point out what I've missed.

Tuesday, November 15, 2011

Late Payment, Adverse Incentives and Monetary Policy

This is a real concern. Laws do exist to limit the time banks can hold deposits before making them available to write cheques on. The Expedited Funds Availability Act in the USA is an example of this that addresses a particular face of this form of moral hazard. I previously heard an anecdote of some bank(s) in the USA being found guilty, a number of decades ago, of wrongdoing by their sending payment (in the form of cheques via snail mail) from the furthest branch away from the destination in order to have access to the customer's money for a day or so more. The sheer volume of payments made this profitable. Insurance and other financial transactions are similar. Long processing times seem like a weak excuse.

I wrote that it may be time for Singapore to deal with the underlying problem. I said that the MAS should determine whether deferred payments may be considered reserve capital. (Yes, money could be used for other things, but I thought pointing to reserve capital as something tangible would make sense.) If the response turns out to be "no", incentives for such, arguably dishonest, corporate behaviour would be reduced.

Monday, November 14, 2011

Public Transport and Queueing Systems

Thursday, November 10, 2011

A Counterfactual Public Housing System (Revised)

I would like to examine a counterfactual. What if, in Singapore, public housing were more tightly controlled by HDB in the following fashion:

- purchase and sale transactions could only be performed with HDB itself,

- prices were controlled so as to preserve only market forces based on location-based desirability to individual buyers while, at the same time, removing the speculative component.

A Counterfactual Public Housing System

The resale price (back to HDB) for a flat would be set according to its type and floor area. Thus, a 1000 square feet four-room flat in Marine Parade would be sold back to HDB for the same amount as a 1000 square feet four-room flat in Pasir Ris. Furthermore, these resale prices would be kept low. (This may be tweaked to account for age and recent upgrading work.) The purchase of flats would be done by sealed-bid auction, with the previously mentioned resale price as the reserve price. (The details of the auction mechanism will be outlined in the Annex.) In addition, if an owner of a HDB flat comes to own any private property in Singapore (through purchase or bequest), that person must dispose of either the HDB flat (to HDB) or the private property.

Due to the low resale prices, there would be no incentive to purchase HDB flats for speculative purposes. Presently, there is a loophole where some foreign nationals (PRs and those with dual citizenships) are essentially able to buy to rent, reducing the strained public housing supply and profiting off the misery of the "flat-less". Measures to plug that loophole will be outlined in the next paragraph. On the other hand, to avoid market distortions where a flat is priced at the same amount as a less desirable one, sale of flats will be done by (country-wide) auction (with a reserve price dictated by the nature of the flat). It is intended that buyers make bids for available flats of all types in all locations so as to eliminate dillemas of whether to participate in an auction for flats of a second choice type or in a second choice location. All this would serve to "defragment" the public housing market and ensure that the premium paid over the reserve price reflects desirability due to location, and does not contain a component pricing potential future speculative profit.

To reduce actual foreign speculative pressure, consider requiring all flat owners holding any foreign citizenships (non-citizens and citizens with dual citizenships) to certify their occupancy of their flats by certifying, in person, every quarter (or some suitable time interval), their occupancy of their flat at their local town council. This will not be onerous as town councils are typically located close by.

The philosophy behind this counterfactual system is that residents derive value from public housing based on the housing space and the location. The actual public housing market, comprising the buyers, is best equipped to price this premium. Hence the auction mechanism. The premium paid over the resale price would reflect the value derived from the flat consumed by the owner over the tenure of residence and, as such, would not be returned when the flat is sold back to HDB.

Implications for Economic Vibrancy and Investment

It follows that without a concomitant increase in prices and without an accompanying fall in wages, lower housing prices will result in higher household savings. (The former two do not appear to follow from lower housing prices.)

The upshot of this is that funds would be available for the enterprising to start businesses. The less entrepreneurial would have funds to invest in those new businesses. With less funds tied up in property, the economic landscape would be fertile enough to encourage new businesses to spring forth and be nourished by the increased availability of funds.

It is not too much of a stretch to project that a number of these new businesses would introduce innovative business models and new uses of technology, thus bringing a new vibrancy to the economy. With this, investment in Singapore will no far less property driven, but rather, innovation led, as befits a knowledge economy.

Closing Remarks

The counterfactual public housing system I have proposed has a number of positive features. However, the problem is how to get from the present state to this one. In my mind, the way forward entails a number of steps (i) legislate that the divestment requirement for all public housing to take effect in a number of years (as existing current legislation to that effect is not retroactive), (ii) begin a two-speed public housing market where the resale of all new flats will be based on this paradigm and current flats can be sold to other buyers or to HDB at the aforementioned resale price.

Step (ii) will result in a gradual conversion of the public housing market to the aforementioned counterfactual system. In decades to come, as newer, more desirable, flats are rolled out, the prices of current flats will naturally decline due to the greater availability of cheaper flats, as well as their age. Eventually they will be sold back to HDB at the dictated resale price, reducing the share of flats held in the old housing system.

Will this take place? It depends on the priorities of the government and the electorate.

At first glance, it might appear that the use of auctions would punish poorer Singaporeans based on the historical use of auctions for selling collectors' items. However, auctions are a direct mechanism to mark to market. Auctions have been used for certain types of items that are difficult to properly value a priori, such as collectors' items whose market value is uncertain. Homes are similar to an extent. HDB and banks cannot properly assess how much value a flat has to a buyer as work location, residents of friends and family, and a host of other factors contribute to this.

I envision the conduct of regular auctions of all available flats in Singapore with the reserve price on each flat set to the aforementioned resale price. Interested buyers would first register with HDB and then be issued with accounts to bid for flats. They would then place bids for each flat they are interested in.

This is my third attempt. The first attempt at a mechanism is featured at the previous post. It was not satisfactory. The second was online just briefly, but was taken down because I realized that an aspect of the proof of strategy-proof-ness was wrong and it couldn't be fixed. (I found a clear counterexample.) This auction mechanism will stand up easily to scrutiny because it is based on a well-known (and well-studied) family of mechanisms called Vickrey-Clarke-Groves (VCG) Mechanisms.

In the auction, each bid price is intended to be the maximum amount the relevant bidder is willing to pay for a flat of a particular type in a particular location. Bidders will make bids for every type of flat they are interested in. The beauty of VCG mechanisms is that the optimal bidding strategy is for a bidder to truthfully bid the actual maximum value he is willing to pay for a flat, the auction mechanism will not use this information to extract additional revenue from him. This is in contrast to situations where perfect price discrimination is possible and buyers have an incentive to hide information on exactly how much they are willing to pay.

To jump the gun, the allocation portion of the auction seeks to maximize allocative efficiency, which is quantified by the total value of the allocation to the bidders defined by the sum of bid prices for all allocated flats (including unallocated flats which are valued at the reserve price. The pricing portion charges each bidder allocated a flat a price which represents "the social cost to society of him having been allocated the flat". Imprecisely speaking, this social cost typically entails the loss to someone else who would have been allocated a flat, and as such, is typically the bid price of the bidder "next in line" to be allocated a flat (the first among the losing bidders). More accurately, the price charged for each allocated flat is precisely the lowest amount the respective bidder could have bid and been allocated the flat.

Annex: The Allocation Model for the VCG Auction

nj: Number of available flats in category j

maximize Sum[over i and j] vij xij

subject to:

- Sum[over flat categories j] xij <= 1 for each bidder i except HDB (1)

Sum[over bidders i] xij = nj for each flat category j (2)

The set of constraints (1) mean that each bidder (other than HDB) may be allocated at most 1 flat. The set of constraints (2) mean that all flats are allocated.

One can prove that if the bid prices (other than HDB's) are all not equal (and another non-equal "difference" condition holds), this integer optimization problem can be relaxed to a linear optimization problem and yield the same solution. (This can be easily engineered and implies big computational savings, which will be necessary for quickly producing an allocation and pricing the allocated flats.) Such a scenario can be engineered by requiring minimal bid increments (of say $100) and incorporating random tie breaking by doctoring bids by random values smaller than the bid increment. This practical measure is similar to allocating flats by ballot, but differs in that it first takes allocative efficiency into account.

Saturday, November 5, 2011

Where the Public Housing System Should Be (With Diagrams!)

Now, many more people can get a flat. Note that the surplus flat buffer allows for all flats to be sold at the reserve price. All viable demand is satisfied. One can see that some people without the means to pay still cannot get flats. Additional government measures may help more people to get flats, up to the flat supply. This has already been done through the creation of another housing market with a lower income ceiling. As for the rest who still fall through the cracks, I don't know. My sense is that a Singapore version of the New Deal could work.

Tuesday, November 1, 2011

A Counterfactual Public Housing System and Its Outcomes

A Counterfactual Public Housing System

The sale price for a flat would be fixed upfront, according to its type and floor area. Thus, a 1000 square feet four-room flat in Marine Parade would be sold back to HDB for the same amount as a 1000 square feet four-room flat in Pasir Ris. Furthermore, these sale prices would be kept low. (This may be tweaked to account for age and recent upgrading work.) The purchase of flats would be done by sealed-bid auction, with the previously mentioned sale price as the reserve price. (The details of the auction mechanism will be outlined in the Annex.) In addition, if an owner of a HDB flat comes to own any private property in Singapore (through purchase or bequest), that person must dispose of either the HDB flat (to HDB) or the private property.

Due to the low, fixed sale prices, there would be no incentive to purchase HDB flats for speculative purposes. Presently, there is a loophole where some foreign nationals (PRs and those with dual citizenships) are essentially able to buy to rent, reducing the strained public housing supply and profiting off the misery of the "flat-less". Measures to plug that loophole will be outlined in the next paragraph. On the other hand, to avoid market distortions where a flat is priced at the same amount as a less desirable one, sale of flats will be done by (country-wide) auction (with a reserve price dictated by the nature of the flat). All this serve to ensure that the premium paid over the reserve price reflects desirability due to location, and does not contain a component pricing potential future speculative profit.

To reduce actual foreign speculative pressure, consider requiring all flat owners holding any foreign citizenships (non-citizens and citizens with dual citizenships) to certify their occupancy of their flats by certifying, in person, every quarter (or some suitable time interval), their occupancy of their flat at their local town council. This will not be onerous as town councils are typically located close by.

The philosophy behind this counterfactual system is that residents derive value from public housing based on the housing space and the location. The actual housing market, comprising the buyers, is best equipped to price this premium. Hence the auction mechanism. The premium paid over the sale price would reflect the value derived from the flat consumed by the owner over the tenure of residence and, as such, would not be returned when the flat is sold back to HDB.

Implications for Economic Vibrancy and Investment

It follows that without a concomitant increase in prices and without an accompanying fall in wages, lower housing prices will result in higher household savings. (The former two do not appear to follow from lower housing prices.)

The upshot of this is that funds would be available for the enterprising to start businesses. The less entrepreneurial would have funds to invest in those new businesses. With less funds tied up in property, the economic landscape would be fertile enough to encourage new businesses to spring forth and be nourished by the increased availability of funds.

Closing Remarks

The counterfactual public housing system I have proposed has a number of positive features. However, the problem is how to get from the present state to this one. In my mind, the way forward entails a number of steps (i) legislate that the divestment requirement for all public housing to take effect in a number of years (the current legislation is not retroactive), (ii) begin a two-speed public housing market where the sale of all new flats are based on this paradigm and current flats can be sold to other buyers or to HDB at the aforementioned fixed price.

Step (ii) will result in a gradual conversion of the public housing market to the aforementioned system. As newer, more desirable, flats are rolled out, the prices of current flats will naturally decline due to the greater availability of cheaper flats, as well as their age. Eventually they will be sold back to HDB at the dictated sale price, reducing the share of flats held in the old housing system.

Will this take place? It depends on the priorities of the government and the electorate.

Annex: An Attempt at an Auction Mechanism

I envision the conduct of regular auctions by district/sub-district and category (based on type, upgrading status, age bracket, size bracket, floor, etc.) with the reserve price on each flat set to the resale price. Interested buyers would first register with HDB and then be issued with accounts to bid for flats. (These accounts will be closed on the successful purchase of a flat.)

Before moving on, the auction described is probably not strategy proof. However, care was taken to reduce the potential gains of strategic manipulation to those reflecting personal preference by stratifying the flats on auction such that they have similar valuations. Having said that, auctions would be carried out as follows:

Each auction will be only for a certain by district/sub-district and category. Naturally, the number of flats will be known to all bidders as well as the reserve prices for each of the flats. The intent of conducting an auction by district/sub-district is to reduce the variation in valuation (resale price) each bidder holds for the available flats in the same category. (Note also the assumption of small per square foot prices.) Thus, bidders will specify a single (sealed) bid price. Each bidder will select only the available flats he/she desires (with reserve prices not exceeding his/her bid) and indicate a preference order on those.

The gist of the auction is that it is similar to the generalized second price auction. Readers for which the above is sufficient may skip the details and go on to the next paragraph. Now, onward. The winners of the auction will be selected in descending order of bid. While there are flats or bidders remaining in the auction, the following process takes place:

- The question "Can parts of the auction be cleared at the reserve price?" is asked. Computationally, the set of bidders is partitioned into "bidder groups" such that for the bidders in a given group, all bidders there do not desire any flat selected by the bidders in all other groups. (This can be visualized by picturing the auction as a graph with bidders as nodes and edges corresponding to common demand for flats remaining in the auction.) For each bidder group, if all demand can be satisfied by allocating, ordered by descending bid price, the most desired remaining flat to all bidders, then all bidders in that group get their desired flats at the reserve price. (Note: "bidder groups" are recomputed at each step, as the removal of a flat can split groups, necessitating a re-check. Of course, a computational improvement can be made over this process.)

- If the top bidder has no flats remaining on his/her list, remove him/her from the auction, doing this until the top bidder has a non-empty list.

- The top bidder wins his/her most preferred flat remaining on his list at the price defined by the next highest bidder's bid or that flat's reserve price if he/she is the only bidder remaining.

- The flat won is removed from all remaining bidders' lists and the current winning bidder is removed from the auction.

The orchestration of the auctions, including the user interface, automation of bidding (such as bidding in a sequence of auctions until a flat is won) and other details can be ironed out at implementation.

Again, this is a sketch of a possible auction mechanism. Clearly it is an attempt, and a better mechanism may be developed. Perhaps with corrections for the (small) differences in flat valuation. (I attempted to incorporate this, but found I had to accept a mechanism with swapping of the order of awarding flats, thus I accepted non-Nash Equilibrium outcomes for comprehensibility.) Hopefully gaming this system would be more effort that it is worth. Perhaps a further analysis of the system would show that it admits epsilon-Equilibria as outcomes.

Monday, October 31, 2011

On Pay For Performance

In this opinion piece, I will discuss the basis of ministerial remuneration and pay for performance. I will talk about the inadequacy of using GDP growth as an indicator and show, by example, how one may easily develop better indicators. My intent is to contribute to the discourse on how we may more precisely reward good performance on the part of our ministers and provide incentives for good policy making.

The Basis for Remuneration

The nation's leadership must be properly remunerated for the time they put in to policy making and for the associated burden of responsibility. Remuneration for this base-load of effort would be partially covered by the non-variable component of their salaries. In addition to this, the nation's leadership should also be rewarded (or punished) for facilitating good (or poor) social, economic, security or foreign relations outcomes. This position is very much in line with what the ruling PAP government has argued in explaining the justifications behind their salaries. While I agree with the idea of pay for performance, I feel it has not been properly implemented.

On Performance Evaluation

What is good performance for government and how can it be evaluated? Presently, GDP growth is used as an indicator that determines a significant portion of ministers’ (and senior civil servants’) bonuses. By and large, it is agreeable that this is insufficient to cover the gamut of areas where government has a significant impact.

In addition to the above, a significant portion of ministerial bonuses is confidential and known only to the Prime Minister and the minister in question. We shall assume that the Prime Minister is privy to the efforts that each minister puts in and is qualified to judge the quality and effectiveness of the initiatives put in place by each minister. Behind this appears to be the assumption that the body politic is not qualified to properly judge these and their input could have a distorting effect on rewarding the deserving and punishing the blundering. This is only partially correct.

Before elaborating on why, let me enumerate on the major components of performance: (i) the standard of living of the body politic, (ii) the delivery and effectiveness of government services, (iii) the state of the business environment, (iv) economic and geopolitical security, (v) the direction of the country and (vi) the effort put in by individual ministers.

I believe that it would also be agreeable that while the body politic are able to evaluate (i) thru (iii), they are not equipped with the information and knowledge to evaluate (iv) thru (vi). Conversely, the Prime Minster is far less qualified than the body politic to evaluate (i) and (ii). The Prime Minister may also be less qualified than the average business owner to evaluate many aspects of (iii).

While we might conclude that the Prime Minister and selected advisors should be the ones to evaluate (iv) thru (vi), and to some extent, (iii), we might also conclude that there are gaps in the evaluation of (i) thru (iii). Furthermore, it is (i), (ii) and aspects of (iii) that the body politic care most about and are most qualified to evaluate. As it is impractical to award ministerial bonuses by referendum, proxy indicators must be used to measure these effects that arise indirectly from the actions of our ministers. These proxy indicators must also be formulated such that the body politic would agree that they measure the aforementioned elements of performance.

On GDP Growth as an Indicator

GDP growth has little relation to (iv) thru (vi), it is also only weakly correlated with (i) and (iii). However, it would appear that GDP growth is, in some sense, being used as a catch-all to evaluate the changes in standards of living, the state of the business environment and even the quality of government services. Supporting the truth of this hunch is the fact that a substantial portion of ministerial (and civil service) bonuses depend on the level of GDP growth. If this does, in fact, reflect reality, then there is a problem.

I would like to, first, justify the inadequacy of GDP growth as an indicator by quickly explaining why GDP is only weakly correlated with (i). There can be many economic outcomes (states) in which GDP growth can be high but large segments of the population experience decreasing standards of living. It is the existence of these outcomes and the likelihood of their occurrence (we have been experiencing these outcomes in recent years) that justifies the contention that GDP is only weakly correlated with (i).

(Note: A more precise mathematical statement on the inadequacy of GDP growth as an indicator could be made along the above lines. In addition, except for effects arising from the regulation of businesses and promotion of competition, it is difficult to relate GDP growth to (ii). Also, it would take more effort and business /economic reasoning to explain why GDP growth is ineffective as an indicator for (iii).)

Proposing a Better Indicator

More effective indicators can be easily developed. As an exercise, consider using real household income growth to build one. We will use a weighted sum of average real household income growth of various segments of the population. For example: 0.5 times the average growth of the lower 50% plus 0.5 times that of the upper 50%. Extending that logic, consider measuring at finer granularities such as 10% segments of households or even 1% segments. For weights, we adopt the "democratic option" of equal weight being given to each individual regardless of income level, which is consistent with our electoral system. Let us call this indicator "Aggregate Real Household Income Growth" (ARHIG) and suppose that ten equally weighted 10% segments are used.

This indicator is consistent with findings in behavioral psychology where percentage growth is what matters and not absolute growth. In addition, prospect theory, which has been empirically verified in a wide range of activities involving expressions of preference, informs us that losses loom larger than gains, which suggests that percentage income contraction should be weighed more heavily than growth. Naturally, the difference in weight between growth and contraction should be determined by a proper survey.

Clearly, ARHIG and similar indicators correlates far better with standard of living. In fact, one could reasonably argue for a causal relation. Furthermore, income growth at all levels may be a better measure of the quality of the business environment as it measures the benefits derived by all elements of the economic hierarchy. I have not thought about this in sufficiently detail and thus can only make a conjecture. On top of all this, ARHIG is eminently easy to explain to the body politic.

As the this section indicates, it is possible to build indicators that are more relevant to ministerial remuneration. I believe in this short section, I have convincingly argued that the ARHIG that we have sketched out is superior to GDP growth as an indicator for standard of living. Competent government economists should have proposed something like this at several points, and if it was, I wonder why it was rejected each time.

Admittedly, we have worked on an indicator for the aspect of performance that is easiest to measure. With more work, one could describe an indicator for (ii) and (iii), though my sense is that a survey of sorts would be needed, necessitating a (secret) sampling process.

Summing Up

In this unexpectedly long opinion piece, we have discussed the basis of remuneration and the measurement of the various aspects of performance. I have explained why GDP growth is a poor indicator for improvements in the general standard of living. To show that it is not difficult to build more relevant measures, "Aggregate Real Household Income Growth" (ARHIG) was presented as a simple indicator that more directly measures improvements in the general standard of living. The fact that such indicators are not used do not square with the fact that many Ivy League and Oxbridge educated economists are working in government ministries. Without good indicators, "pay for performance" does not mean anything. Thus, the failure to use better indicators should be explained. In so far as the ruling party is correct that rewarding good performance is a vital ingredient for good government, the lack of good indicators of performance is harmful and is a problem that should be addressed with haste.

Sunday, October 30, 2011

A Route to Value Creation: Cut Out Unnecessary Middle Men

- Recall the fiasco last year, after the Housing Board put up a tender for a market and food centre to be wholly operated by a private operator in Sengkang. This was a pilot project following calls from HDB flat dwellers for wet markets and hawker centres to be built.

Renaissance Properties, a subsidiary of foodcourt chain Kopitiam, beat 24 others with the highest bid to build and run the centre at $500,100 a month. That bid, however, translated into rents as high as $6,000 per stall, which is more than double the average rent for a stall in an NEA-run centre. As a result, stallholders charged about 30 per cent more for their cooked food than stalls elsewhere. Residents complained, or stayed away. Business was poor and some stalls were forced to close.

...

Throughout, hawker stall rents have been kept moderately low, as an incentive for hawkers to price their food affordably. About 42 per cent of stallholders in NEA-run centres pay subsidised rent of between $160 and $320 per month. These are either hawkers who were relocated from street stalls, or their immediate family members.

The other stalls are tendered out for between $300 and $4,900 per month. This rental is based on a valuer's assessment, taking into account stall size, location and the prevailing economic climate.

With respect to her station, she is wrong. Basic undergraduate level economics would inform one that the commercial operator would attempt to raise rents as high as possible while making the rental transaction feasible with respect to the stallholder's participation constraint. Stallholders will participate in the rental transaction as long as they are able to make a living at the store and will raise prices if necessary to do so. This contention can be supported empirically. Kopitiam is known to attempt to estimate revenues of their tenants and raise rentals for the stalls that are doing well. It would be unsurprising if other landlords do the same.

(Naturally, if a stallholder expects to be able to make a better living at another location with a different rental, he will. However, when NEA-run stalls are not available, stallholders have to turn to commercial landlords, who have no incentive to lower rentals as they know the market can sustain their asking price. )

High rentals and raising rentals for successful stalls are a mechanism landlords use to transfer the economic value generated by stallholders to them. This strikes me as unfair. Without commenting further on equity between landlord and stallholder, I'd like to point the reader to the obvious negative externality that the economics leads to: higher prices, which reduce value for Singaporeans. The fact of the matter is, both theory and empirical evidence point to private profit seeking operators causing higher prices. The onus is thus on SMOS Fu to show that they do not.

On a more general note, this highlights a more general problem where the government enables middlemen to extract economic value from the primary value generators while generating little value themselves. In certain areas, middlemen do generate value. For instance, linking borrowers to savers is an economically valuable role performed by banks.

The government's justification for outsourcing tasks like management of food centres is that it does not want public service manpower performing non-core tasks. The government should bear in mind that this should not be done at the expense of value for the public.

It is axiomatic that commercial entities will not take on projects if good profits cannot be made. This profit has to come from somewhere. The government should keep this in mind when divesting operations. Where middlemen are unnecessary they should be cut out, otherwise they will extract value from the end-user (the public). In such cases, the public service does the people no service. Presently, value can be recaptured for the public (and value generators) by rolling back divestments that destroy value for Singaporeans.

Tuesday, October 25, 2011

Economic Data Should Be Revealed to All

However, one of the articles hints that some academics have been lobbying for economic information to be revealed to them without public release. One of the above articles reported that an economist has urged the Central Provident Board to "trust Singaporean academics not to reveal data at the micro level". I believe such selective revelation to be wrong.

I take exception to the implicit contention that academic economists should receive raw economic data from the government while taxpayers and business owners who actually finance the collection of that data are kept in the dark. More tangibly, such data has commercial value and should be revealed to all so as to avoid granting unfair potential commercial advantages to a few parties, current and former government employees included.

It may also be noted that private sales of the results of analyses of the data may take place that do not violate the letter of any agreement to not reveal raw data. In fact, to the numerically savvy, this can be done in a manner such that it becomes relatively easy to "invert" for a good partial picture of the raw data. (The technical term would be to deconvolve aggregated results.)

Furthermore, selective revelation poses the further problem of selecting from the number of academics assessed to be competent enough to produce useful analyses those that are "trustworthy".

All data should be released so all businesses and analysts can benefit from it to the extent of their capability to analyse. This is the fair option, and the Singapore economy will be richer off for it.

Monday, October 24, 2011

On Singapore's Long Term Economic Viability: Tertiary Education in Science and Engineering

Monday, October 17, 2011

The Proper Role of Business

Thursday, October 13, 2011

On Producing High Value While Tolerating Low Quality,

Saturday, October 1, 2011

Ramblings on Self-Radicalization

In a way, this as an attempt to draw an artificial dividing line between "us reasonable people" and "those who would promulgate senseless chatter" that is wasteful and should be "considered harmful". I'd like to ramble a little about this so called "self-radicalization" and consider why it may be the appropriate reaction of reasonable people.

When one hears of famine in Africa and children dying, one feels sad. When one hears that many innocents were killed in a terror attack, one feels angry. When one is told of how one's social/ethnic group has been systematically marginalized by those in power, one gets very angry. Information often supplies the motive force for one to take action. This information may be unbiased or biased. Whatever the case, if it is taken to be a good reflection of reality and resonates with the recipient, that individual may be driven to action. This is a fact of life, and applies to all but the most apathetic.

Perhaps this is why people leave well-paying jobs to serve the underprivilleged; this is why people volunteer to support social causes; this is why positive action happens. (The flip side to this exists and should be acknowledged.)

Naturally, news and direct observations about the state of Singapore naturally touches Singaporeans; Information about the way the ruling party and its associates behaves would necessarily have resonance with Singaporeans. When people feel that something is wrong, they are driven to say something. Inarticulate as such a statement might be, there is probably something behind it. If it is backed by action, it is all the more certain that something is behind it.

Since disenchantment and jadedness sets in when good intentions are thwarted and denigrated, the prevalence of the jaded Singaporean can be easily explained.

So the question for the labellers to ask themselves is, why are people being, in their words, "self-radicalized". Simply tossing out a label is cheap and somewhat dishonest. When people are driven to action, something important and salient to them probably underlies that action. The only responsible thing to do is to find out what drives such action, and address it in good faith. Anything less is not acceptable.

Some Ramblings on Privacy and Security

Power companies, too, are able to monitor power usage in our homes, and by trying to solve an appropriate inverse problem, are able to estimate what is going on. This might entail what appliances are present, and what kinds of activities occur at what time.

The question is, what do we, as a society deem to be reasonable use of that information. In some manner of speaking, we are willing to trade some privacy for security. On one hand, there will be little opposition to the use of cellular phone tracking to pin point the location of terrorists en route to commiting a planned attack. On the other hand, the sale of such information to commercial entities for marketing purposes will be frowned upon by society at large.

Legal and regulatory lines have been drawn, so I will not go into those. However, in the wild west of the global network, one concern is the security of such information. Nefarious parties may get access to such information and use it for their profit. Even more sinisterly, unethical elements in telcos may collude with such nefarious parties to open backdoors to stored data and hence sell private information through a criminal front while hiding the breach.

Storage should be avoided to protect privacy. However, storage is necessary to identify possible terrorists through data mining. It is thus thoroughly annoying that telemarkets turn out to be the proxy elements of terrorists, causing daily disruptions costing millions in lost productivity daily. Once again, the terrorists win.

Tuesday, August 23, 2011

On Investing Sovereign Wealth

Growth is vital to Singapore's survival. This point has been continuously reiterated by the Singapore government. This is straightforwardly believable due to the tight coupling of the Singapore financial system (and hence, economy) to global capital markets.

It is sad, that Singapore is pursuing a labour supply growth policy rather than an productivity growth strategy. This does not make sense in the long term as ever more foreign workers have to be brought in to maintain growth, and the retirement age can be pushed back only so far. Growth is distinct from maintaining a stock of manpower, it requires continued increase in the manpower stock. Noting the presently strained infrastructure, drastic expansion in our infrastructure would be necessary to sustain further labour supply growth. The pursuit of labour supply growth is the easy way out, and it doesn't make too much sense.

It would be even sadder, to see parents with an intelligent child who choose to invest their savings in the stock market in pursuit of capital gains rather than send their child to university. Even more unconscionable would it be for them to have enough to do both, but only invest in stock and keep the balance as a rainy day fund.

It is thus sad that a large proportion of Singapore's reserves have been used to invest in (bail out), for instance, UBS (S$14.5 billion by GIC in 2007), Citibank (S$9.8 billion by GIC at the beginning of 2008), Merrill Lynch (S$7 billion by Temasek Holdings in 2007). The quick gains sought in those investments have not yet materialized, after more than 3 years. They are presently snorkelling, metaphorically speaking, and with a rather long snorkel.

Capability development has not received government support to a comparable degree. Let's take stock of recent efforts:

- A*STAR was a good try, previously helmed by a good (but controversial) man who was driven by the goal of creating economic growth for Singaporeans (i.e.: job creation). A*STAR has yet to become a national research commercialization powerhouse. It is not entirely clear whether A*STAR is on track or has gone off the rails, but we can hope that it pursues the good staffing and HR policies necessary for research and development success.

- SUTD appears to be a better one. I believe that its focus on design and development (i.e.: real engineering) are a step up from our existing universities. I base this judgement on my sense of MIT its faculty, a presentation by Tom Magnanti and looking over its curriculum.

- MOE's mandating Social and Emotional Learning (in 2004) looks like a positive capacity building policy. In my mind it is an excellent one. I project a sea change in the work force when the effects of this change in the way we educate our young eventually surfaces in the economy.

I would like to see Singapore's reserves being used in strategic investments. Technology firms, infrastructure, engineering. Not banks. Such investments could promote local capability development and technology transfer through steering companies invested in towards joint ventures set up by appointed board members. They might steer advanced businesses towards setting up in Singapore and exposing Singaporeans to cutting-edge technology and business processes.

Philosophically, I regard investments as a sacrifice of present day consumption to build capacity for the future. Let us invest our sovereign wealth to the ends of building national capacity. It is the right thing to do.