Growth is vital to Singapore's survival. This point has been continuously reiterated by the Singapore government. This is straightforwardly believable due to the tight coupling of the Singapore financial system (and hence, economy) to global capital markets.

It is sad, that Singapore is pursuing a labour supply growth policy rather than an productivity growth strategy. This does not make sense in the long term as ever more foreign workers have to be brought in to maintain growth, and the retirement age can be pushed back only so far. Growth is distinct from maintaining a stock of manpower, it requires continued increase in the manpower stock. Noting the presently strained infrastructure, drastic expansion in our infrastructure would be necessary to sustain further labour supply growth. The pursuit of labour supply growth is the easy way out, and it doesn't make too much sense.

It would be even sadder, to see parents with an intelligent child who choose to invest their savings in the stock market in pursuit of capital gains rather than send their child to university. Even more unconscionable would it be for them to have enough to do both, but only invest in stock and keep the balance as a rainy day fund.

It is thus sad that a large proportion of Singapore's reserves have been used to invest in (bail out), for instance, UBS (S$14.5 billion by GIC in 2007), Citibank (S$9.8 billion by GIC at the beginning of 2008), Merrill Lynch (S$7 billion by Temasek Holdings in 2007). The quick gains sought in those investments have not yet materialized, after more than 3 years. They are presently snorkelling, metaphorically speaking, and with a rather long snorkel.

Capability development has not received government support to a comparable degree. Let's take stock of recent efforts:

- A*STAR was a good try, previously helmed by a good (but controversial) man who was driven by the goal of creating economic growth for Singaporeans (i.e.: job creation). A*STAR has yet to become a national research commercialization powerhouse. It is not entirely clear whether A*STAR is on track or has gone off the rails, but we can hope that it pursues the good staffing and HR policies necessary for research and development success.

- SUTD appears to be a better one. I believe that its focus on design and development (i.e.: real engineering) are a step up from our existing universities. I base this judgement on my sense of MIT its faculty, a presentation by Tom Magnanti and looking over its curriculum.

- MOE's mandating Social and Emotional Learning (in 2004) looks like a positive capacity building policy. In my mind it is an excellent one. I project a sea change in the work force when the effects of this change in the way we educate our young eventually surfaces in the economy.

I would like to see Singapore's reserves being used in strategic investments. Technology firms, infrastructure, engineering. Not banks. Such investments could promote local capability development and technology transfer through steering companies invested in towards joint ventures set up by appointed board members. They might steer advanced businesses towards setting up in Singapore and exposing Singaporeans to cutting-edge technology and business processes.

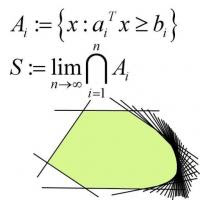

Philosophically, I regard investments as a sacrifice of present day consumption to build capacity for the future. Let us invest our sovereign wealth to the ends of building national capacity. It is the right thing to do.

No comments:

Post a Comment